coinbase pro taxes uk

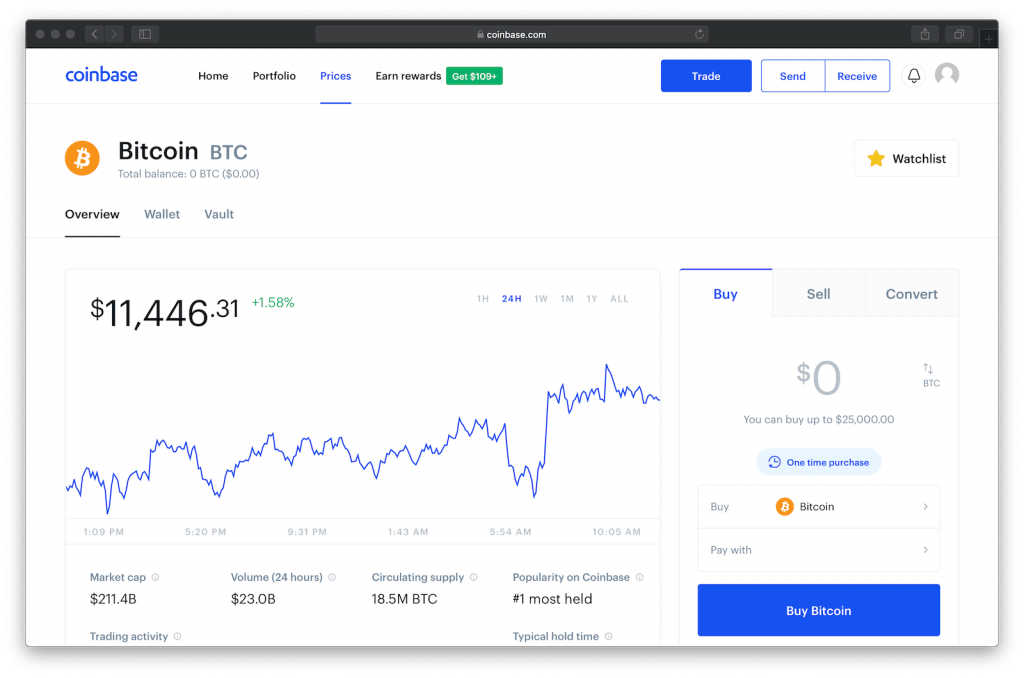

Trade Bitcoin BTC Ethereum ETH and more for USD EUR and GBP. Coinbase Pro Tax Reporting.

Koinly Blog Cryptocurrency Tax News Strategies Tips

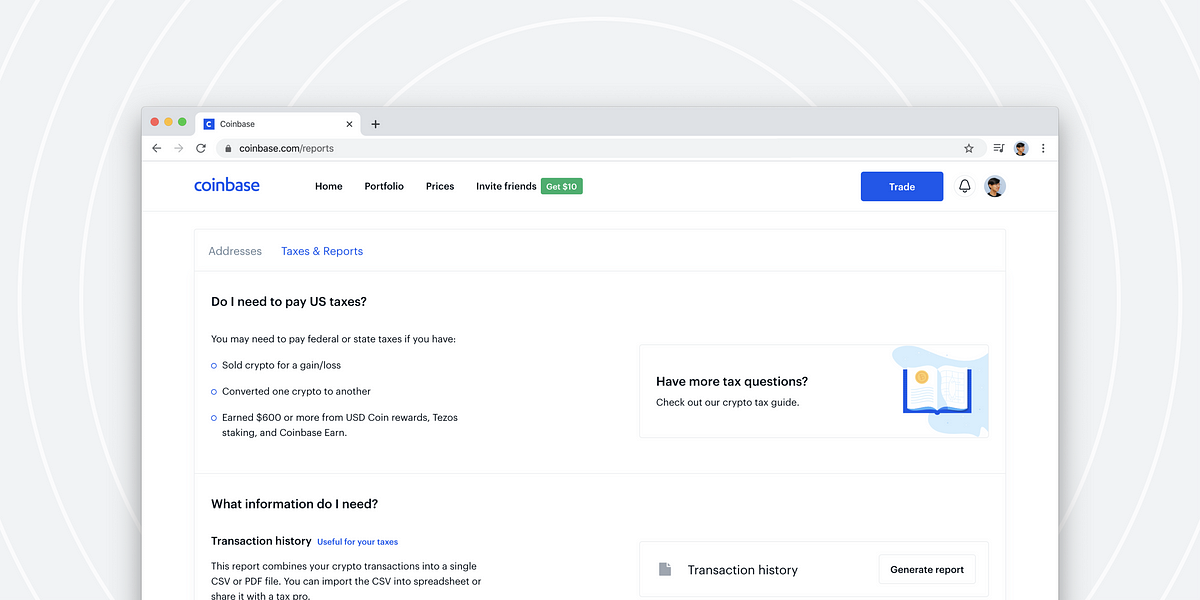

You can generate your gains losses and income tax reports from your Coinbase Pro investing activity by connecting your account with CoinLedger.

. If you need professional support ZenLedger can introduce you to a crypto tax professional eg a tax attorney CPA or Enrolled Agent to get your crypto and non-crypto taxes done quickly and accurately using the smartest tax strategies. Tax is also paid at a different rate depending on how long the assets are held. 12570 Personal Income Tax Allowance.

A Coinbase Pro account comes with a relatively simple fee structure whereby your fees are calculated according to your trading volume in the previous 30 days. Connect your account by importing your data through the method discussed below. Assets held over a year or more are subject to long-term capital gains tax while assets bought and sold within a year are subject to short term capital gains rates.

UK residents who have invested through the American based firm Coinbase will have their details passed to HMRC. Now available in United Kingdom and in 100 countries around the world. Learn more about how to use these forms and reports.

For other specialized reports we recommend connecting your account to CoinTracker. Support for FIX API and REST API. The Coinbase cryptocurrency platform is getting ready to send over details of some of its United Kingdom-based customers to the Tax Authority in the country.

The interesting thing about this is that the HMRC in the. Users of the Coinbase exchange to own more than 5000 in cryptocurrency in the UK are going to have the details sent over to the HMRC. Coinbase UK Disclose Cryptocurrency Owners to HMRC.

Non-US customers will not receive any forms from Coinbase and must utilize their transaction history to fulfil their local tax obligations. Coinbase is the most trusted place for crypto in United Kingdom. The provisions of this Appendix 4 Coinbase Pro Services apply to your use of such Coinbase Pro Account in addition to the other applicable provisions of this Agreement including without limitation the releases indemnities disclaimers limitations of liability prohibited use dispute resolution and cancellation policies set forth above.

Crypto NFT Taxes done fast. You have been invited to use CoinTracker to calculate your cryptocurrency taxes. You can download your tax report under Documents in Coinbase Taxes.

For individuals in the following states the threshold for receiving a 1099-K is much lower. Easy safe and secure Join 98 million customers. Visit the Statements section of Pro to download Pro transactions.

Coinbase charges a higher amount. According to Coinbase the base rate for all purchase and sale transactions in the US. Then you can either upload this to a crypto tax app or do your Coinbase taxes manually.

The UK taxman has scored a success in its ongoing attempts to obtain details about UK holders of crypto-currencies. Your first 12570 of income in the UK is tax free for the 20212022 tax year. Coinbase users who make at least 600 in activities like rewards or fees from Coinbase Earn USDC Rewards and staking receive an IRS form 1099-MISC at the start of the tax filing season.

To get to the new tax center all you have to do is log into Coinbase tap your profile in the upper right corner and select the new Taxes. For advanced traders this is the most cost effective way of trading at Coinbase. If you hold your crypto for no more than 12 months before selling it youll be subject to a short-term capital gains tax rate ranging from 10 to 37.

There are two main fees to be aware of the taker fee and the maker fee. Sign up with Coinbase and manage your crypto easily and securely. When you place an order that gets partially matched immediately you pay a taker fee for that portion.

Coinbase Tax Resource Center. Taxes are only paid on any gains not the full amount of the crypto held. Easily sync wallets and generate tax forms.

This matters for your crypto because you subtract. Youll get 10 off our tax plans by signing up now. What About Coinbase Pro Tax Documents.

United Kingdom Buy sell and convert cryptocurrency on Coinbase. Coinbase Pro fees. If another customer places an order that matches yours you are considered the maker and will pay a fee between 000 and 040.

Trusted by 1 million users. Heres how to get your Coinbase trade history export. This allowance was 12500 for the 20202021 tax year.

Easily deposit funds via Coinbase bank transfer wire transfer or cryptocurrency wallet. If you hold that same crypto for more than 12 months youll be subject to a long-term capital gains tax rate ranging from 0 to 20. These plans range from 750 to 2500 per year depending on your number of transactions total asset value.

Heres some good news for crypto taxes. At the time of writing the platform supports over 350 exchanges 50 wallets and 6000 blockchains so importing the history of all your cryptocurrency transactions wont be a problem. If you sell or spend your crypto at a loss you dont owe any taxes on the transaction.

You only owe taxes if you spend or sell it and realize a profit. Next select privacy and find the request data export button. But the fees vary based on your location and payment method.

If you bought 10000 in Bitcoin and sold it for 13000 for example your taxable gain would be 3000. Coinbase Pro exports a complete Transaction History file to all users. If theyve taken more advanced steps like sending or receiving crypto from Coinbase Pro or external wallets they can receive free tax reports.

Log in to your Coinbase account and click on your profile icon in the top right corner then go to settings. The tax reporting feature on the other hand costs between 49 and 279 per year depending on how many crypto trades you did. Coinbase does not offer Coinbase Pro to.

If you are a Coinbase Pro customer and you meet their thresholds of more than 200 transactions and 20000 in gross proceeds then you will receive the IRS Form 1099-K instead of the 1099-Misc. The remainder of the order is placed on the order book and when matched is considered a maker order. In 2019 HM Revenue and Customs sent formal Information Notices to.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Now Coinbase Can Help You Calculate Your Cryptocurrency Taxes In Three Simple Steps Bitrazzi

3 Steps To Calculate Coinbase Taxes 2022 Updated

3 Steps To Calculate Coinbase Taxes 2022 Updated

Uk Cryptocurrency Tax Guide Cointracker

Crypto Tax Uk Explained What You Pay On Crypto Gains In 2022

3 Steps To Calculate Coinbase Taxes 2022 Updated

Coinbase Vs Coinbase Pro What The Difference Crypto Pro

Beware Coinbase Caused Me To Be Audited By The Irs And A Lien Garnished Wages Imposed For Income I Didn T Make R Bitcoin

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

![]()

Cointracking Crypto Tax Calculator

Coinbase 1099 What To Do With Your Coinbase Tax Documents Lexology

Uk Cryptocurrency Tax Guide Cointracker

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Coinbase Resources For 2019 Tax Returns By Coinbase The Coinbase Blog

Uk Cryptocurrency Tax Guide Cointracker

Top 10 Uk Exchanges To Get Crypto Tax Reports Koinly